Introduction

In the growth of eCommerce, CLV (Customer Lifetime Value) is a crucial KPI. However, the standard calculation method poses practical challenges. This article is intended for eCommerce marketing professionals and explains the importance of CLV, its practical calculation and management methods, and representative methods to improve CLV.

What is CLV?

CLV (Life Time Value) is translated as "customer lifetime value" and is also referred to as CLV (Customer Lifetime Value). It signifies the average total profit a customer brings to a company throughout their lifetime. CLV can measure how valuable each customer is to a brand.

This metric should be viewed as a business management indicator rather than a marketing KPI. It can be utilized cross-departmentally. For instance, it can serve as a metric for adjusting advertising investments, focusing on increasing repeat purchases, optimizing the cost rate of products, etc.

Why is CLV important in EC?

The primary reason CLV is emphasized is the increasing difficulty in acquiring new customers. With the advancement of IT technology, the barrier to starting a business has become much lower than before. Regardless of company size, various tools make it possible to promote products in many ways.

In the eCommerce industry, the model of growing business by increasing new customers through advertising is reaching its limits. Data from 2022 suggests that the cost of customer acquisition has worsened by 30-50%.

On the other hand, from the customer's perspective, those who once chose products through mass media now have the option to select their preferred products due to the prevalence of PCs and smartphones. With the diversification of customer needs today, seeking products that fit one's preferences and values beyond price is becoming a standard consumer behavior.

As a result, for eCommerce stores, building a long-term good relationship with existing customers and getting them to continue purchasing is key to business growth. Therefore, the CLV, which indicates how much revenue a single customer brings throughout their lifetime, is increasingly seen as an objective indicator.

Standard CLV calculation method and its practical issues

Standard Calculation Method

The calculation method faithful to the definition "How much profit will one customer bring throughout their lifetime?" is as follows:

Average Order Amount * Purchase Frequency * Customer Lifetime * Gross Profit Rate

For a concrete calculation based on this definition:

- Average order amount: 50 USD

- Average number of purchases per month: 2 times

- Customer lifetime: 2 years

- Gross profit rate: 30%

CLV can be calculated as:

50 USD * 2 times/month * (2 * 12 months) * 30% = 720 USD

Please note that the purchase frequency is the number of times per a certain period.

In this case, calculations are done on a monthly basis, so the customer's life is also converted and calculated in months. If you want to calculate using the average annual purchase frequency, you need to calculate the customer's life in years.

Two Practical Issues with the General Calculation Formula

While this formula is very clear and easy to understand, when applied to the actual situation of an eCommerce store, several questions arise.

How do you calculate when the profit rate varies by product?

If it's a single product lineup, the discussion would end by applying the gross profit rate at the end. However, for stores with many SKUs/lineups, the gross profit rate varies significantly by product.

Of course, simply using the average gross profit of all products is incorrect.

If you can manage the gross profit rate by product, for instance, you can solve this problem by deriving numbers like "average order gross profit amount" instead of the average order amount. But how many stores can do that?

How should the customer's lifespan be predicted?

When CLV is calculated according to the above definition, the customer's lifespan is a predicted value in almost all cases. In other words, the person calculating often determines an arbitrary value.

Shopify, which operates an eCommerce platform, suggests using 3 years as the customer's life if it's unknown, based on the calculation method they published.

Reference Article: Shopify Blog on Customer Lifetime Value

But how reliable is this assumption? If the real average lifespan was 1.5 years, according to the definition, the actual CLV would be halved. Relying on such uncertain predictions for business KPIs could be seen as irrational and impractical.

In the case of eCommerce businesses, it's challenging to determine when a customer's "lifetime" has ended. Customers who have been inactive for several months might return due to an email campaign. Conversely, customers who made multiple purchases in a month might not buy anything the following month. These are common scenarios that eCommerce marketers might frequently observe.

Supplement

If your eCommerce store has introduced a subscription system, you can relatively accurately predict the customer's lifespan and calculate CLV using the formula below:

Average Customer Lifetime (in months)=1 / Monthly Cancellation Rate (%)

For instance,

- If the total number of customers at the beginning of August is 1,000

- And 100 customers cancel during August

The cancellation rate for that month can be calculated as 10%.

By doing this calculation over several months and averaging the numbers, you can make a reasonably accurate prediction of how many customers will cancel each month. The average customer lifetime is calculated by taking its reciprocal.

Thus, if the monthly revenue per customer (called MRPU in the subscription field) is

CLV = 100 USD / 10% = 1,000 USD

Practical CLV Calculation Method in eCommerce

Considering these issues, we will introduce a more practical CLV calculation method.

Pattern Calculated by Sales

This calculation method excludes the gross profit rate from the previous formula:

Average Order Amount * Purchase Frequency * Customer Lifetime

From the standpoint of eCommerce marketing professionals, in many cases, the gross profit rate (cost) of products is out of their control. Therefore, this calculation method might be sufficient as a management metric for marketing activities.

Interestingly, most information sites for eCommerce stores in English-speaking countries adopt this calculation method. Since it uses data managed on the eCommerce store, it's very practical.

Pattern of Managing Using Realized CLV (Total Purchase Amount) without Predicting Customer Lifespan

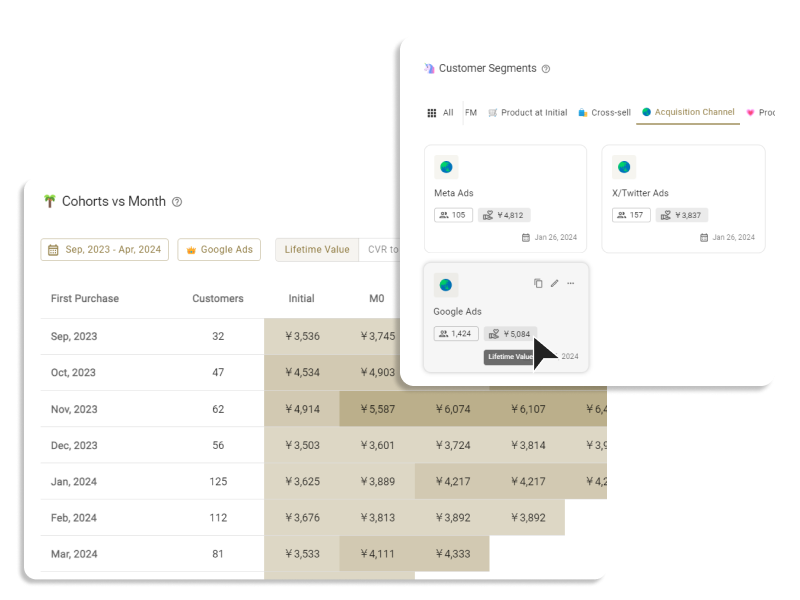

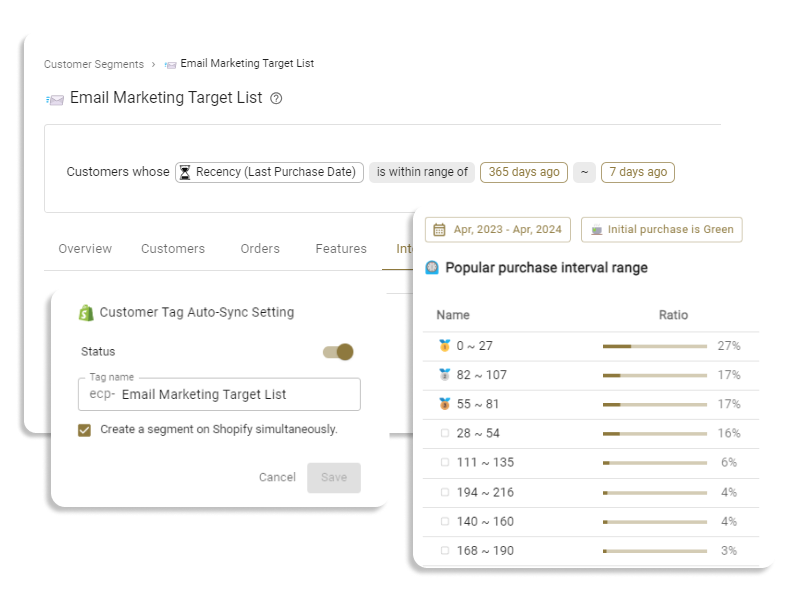

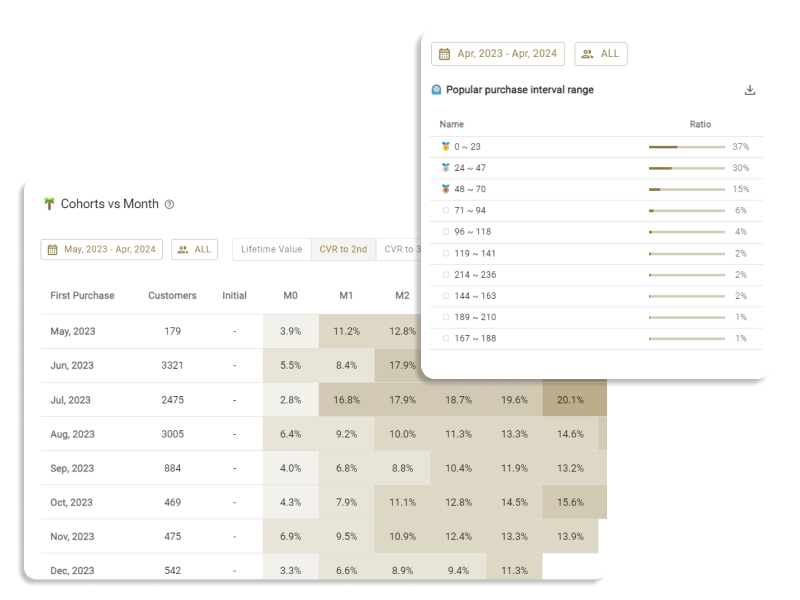

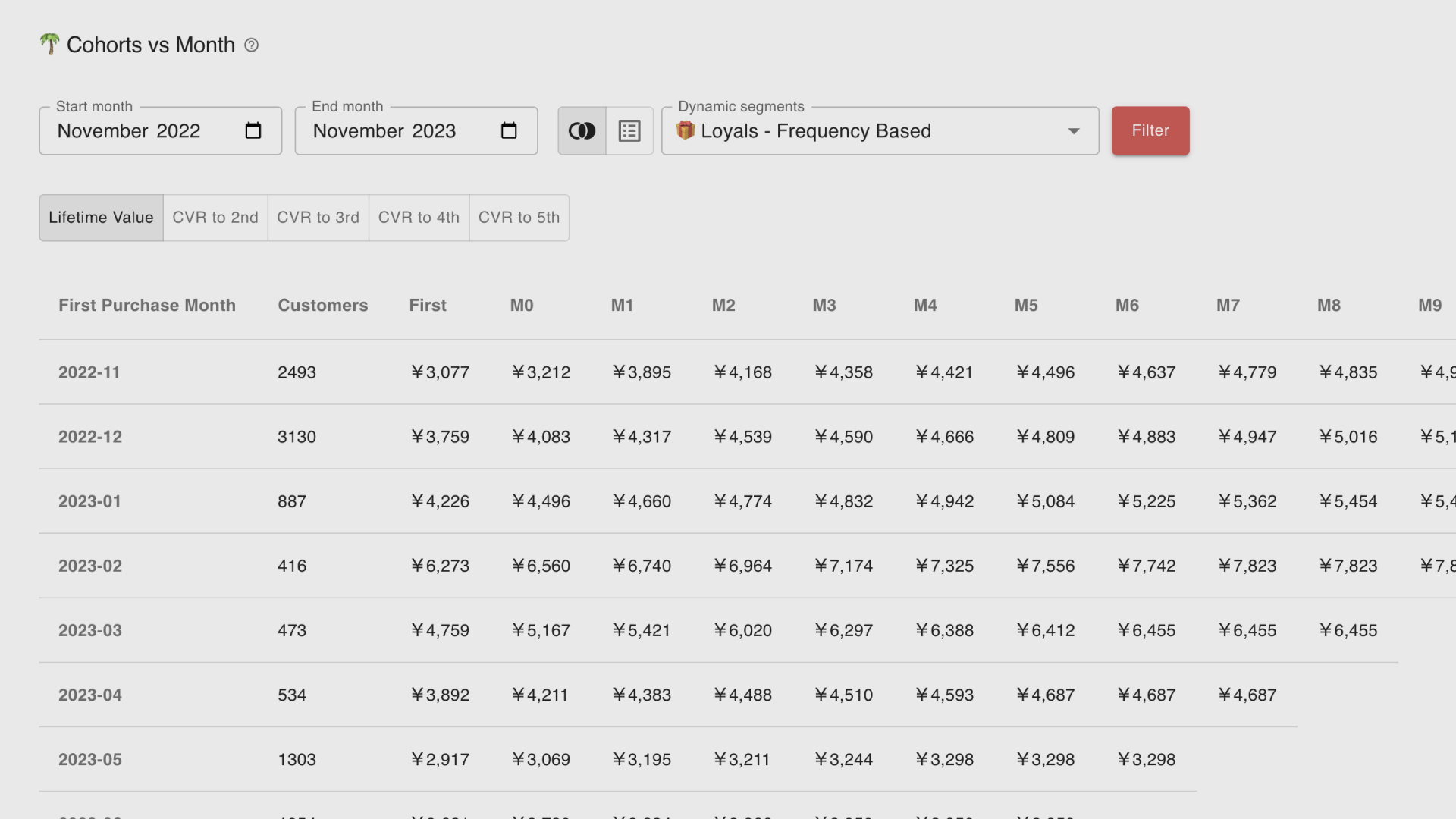

In most cases, predictions about the customer's lifespan tend to be subjective. Hence, there's a pattern where only realized values are used for management. This involves managing the "N-month CLV" as a leading indicator.

For example, by using a metric like the "CLV (total purchase amount) at the 3-month mark from the first purchase," you can calculate using confirmed actual figures for customers who have been with you for at least three months.

This allows you to clearly determine whether the "CLV is improving."

For instance, comparing side by side:

- The 3-month CLV for customers who made their first purchase in May = 40 USD

- The 3-month CLV for customers who made their first purchase in June = 42 USD

- The 3-month CLV for customers who made their first purchase in July = 46 USD

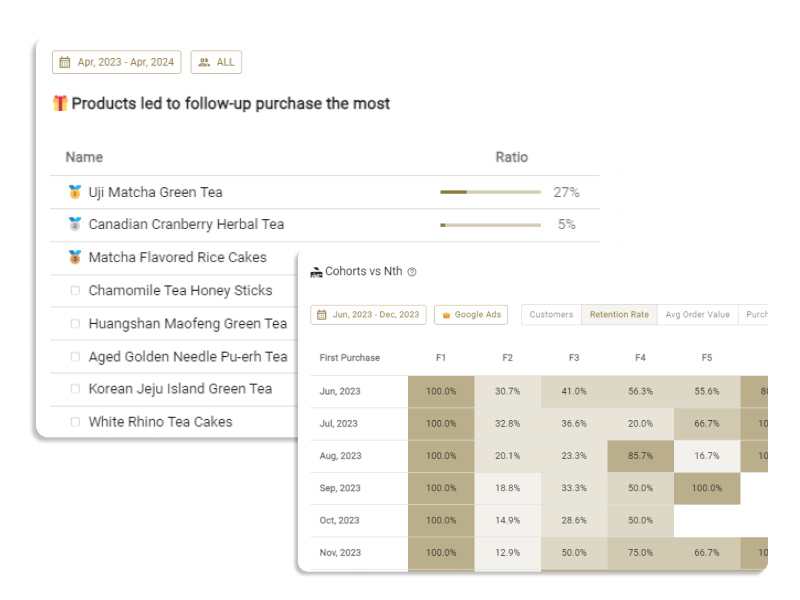

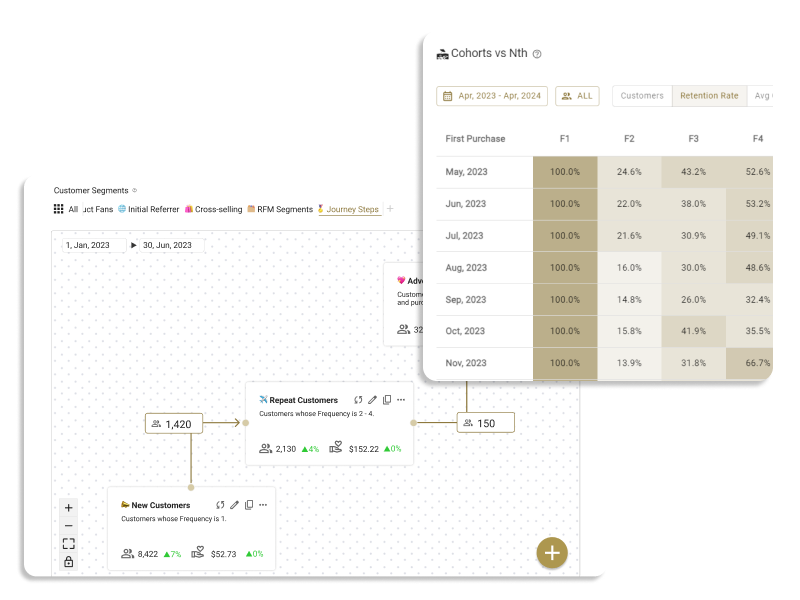

It can be determined that the CLV at the 3-month mark is improving over time. This can be visualized clearly when combined with "cohort analysis."

For managing CLV using "cohort analysis," more details are introduced in another article (link not provided here).

As shown above, while it's essential to calculate accurately based on the definition, it's even more crucial to determine which metrics to manage in practice for your business.

Framework and Representative Methods for Improving CLV

Various methods to improve CLV are introduced online, but let's introduce the basic concept.

Returning to the definition of CLV, it can be broken down into elements: "average order amount," "purchase frequency," and "customer lifespan." It's simple, but improving each of these values enhances the CLV.

Various methods introduced online target the improvement of which value. It's vital to proceed with the examination with a sense of purpose, considering which points to be mindful of when implementing them.

In this article, we will introduce some representative methods.

Methods to Increase the Average Order Amount

- Upselling: This is an approach where customers are encouraged to buy a more extensive or more expensive premium version of the product they have or are about to purchase. It's a crucial measure that contributes to improving CLV by directly increasing the "average order price."

Reference article:

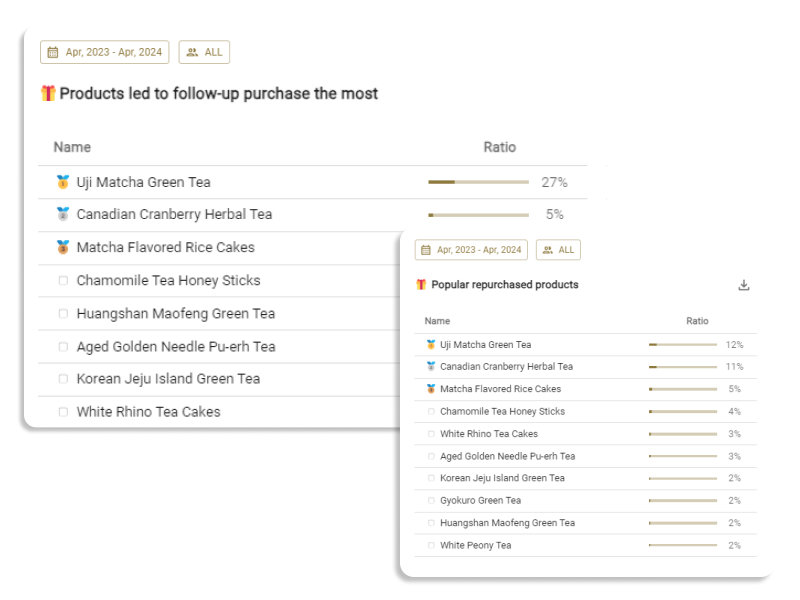

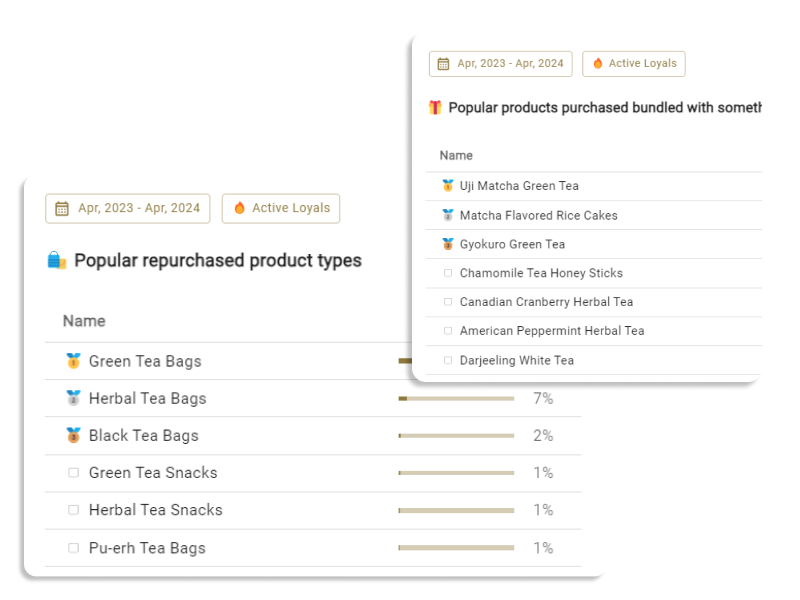

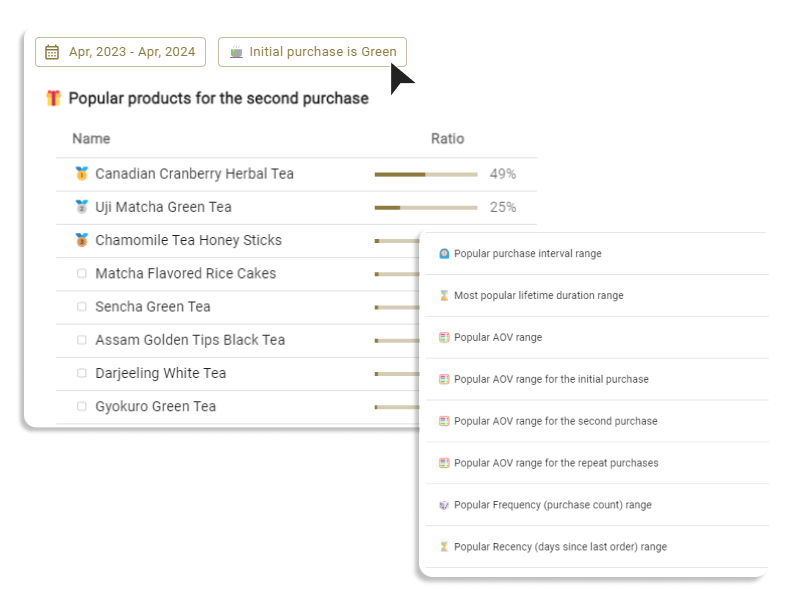

- Cross-selling: Cross-selling is a marketing technique that encourages customers to purchase products that are related or complementary to the product they have or are about to buy. Like upselling, this approach can directly increase the "average order price" and is a crucial measure for improving CLV.

Reference article:

Increasing Purchase Frequency per Set Period:

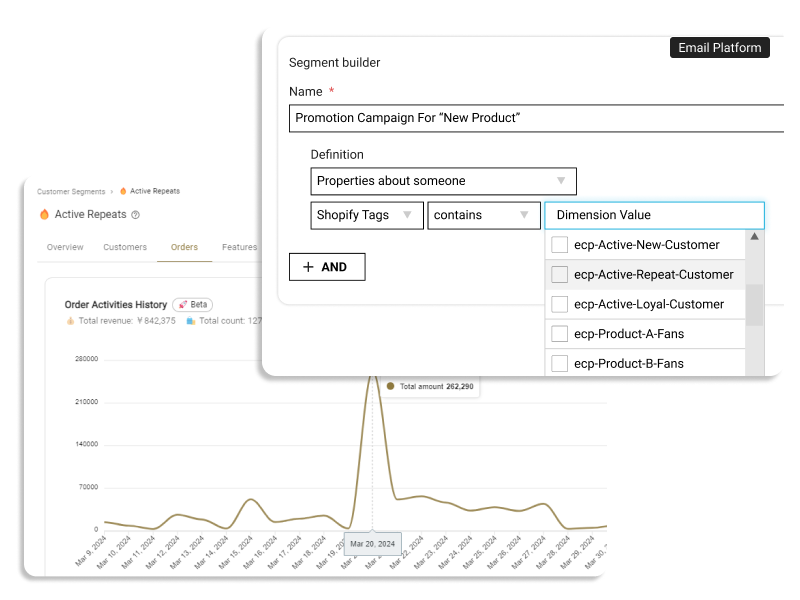

- Utilizing Email Marketing: Email marketing maintains regular touchpoints with existing customers, improving "purchase frequency" and "customer lifespan." This strategy is a vital means to enhance CLV. Furthermore, by implementing email marketing that utilizes segmentation, if you can promote several products tailored to customer needs and preferences, you can expect a positive impact on the "average order amount."

Reference article:

Extending Customer Lifespan:

- Considering the Introduction of Loyalty Programs: A loyalty program is a marketing strategy that provides benefits to customers who continuously use a service or purchase products. For instance, offering members exclusive product purchases, discount opportunities, or various incentives strengthens touchpoints with the brand and encourages repeat purchases. The primary purpose of loyalty programs is to enhance customer retention, stabilize revenue, and differentiate from competitors.

Reference article:

- Considering the Introduction of Subscriptions: The general definition of regular purchase or "subscription" refers to a business model where customers commit to purchasing a product or service regularly, and the company typically provides benefits, like discounted prices. Subscriptions are very effective in stabilizing "order frequency" and extending "customer lifespan", making them a crucial means to improve CLV. Additionally, it can reduce the cost of marketing activities aimed at encouraging repeat purchases from existing customers, having a significant positive impact on CLV from a cost perspective.

Reference article:

Managing and Improving CLV by Customer Segment:

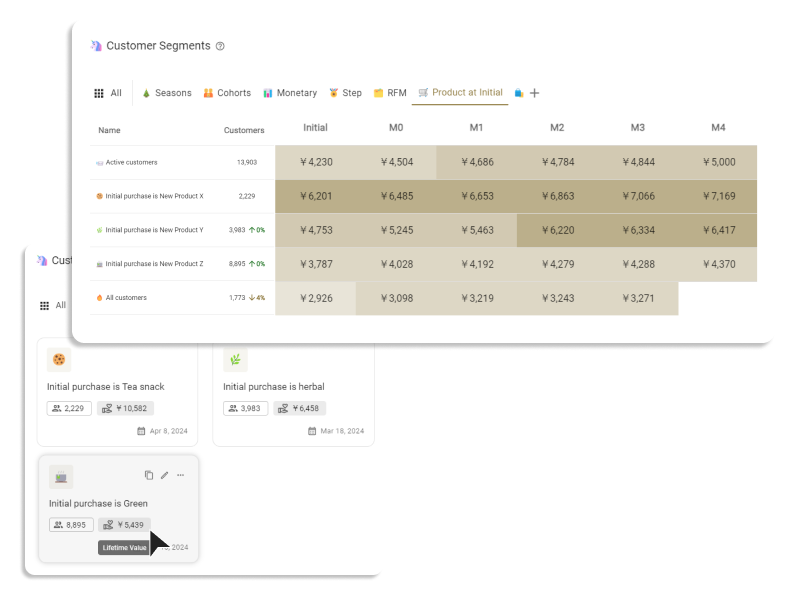

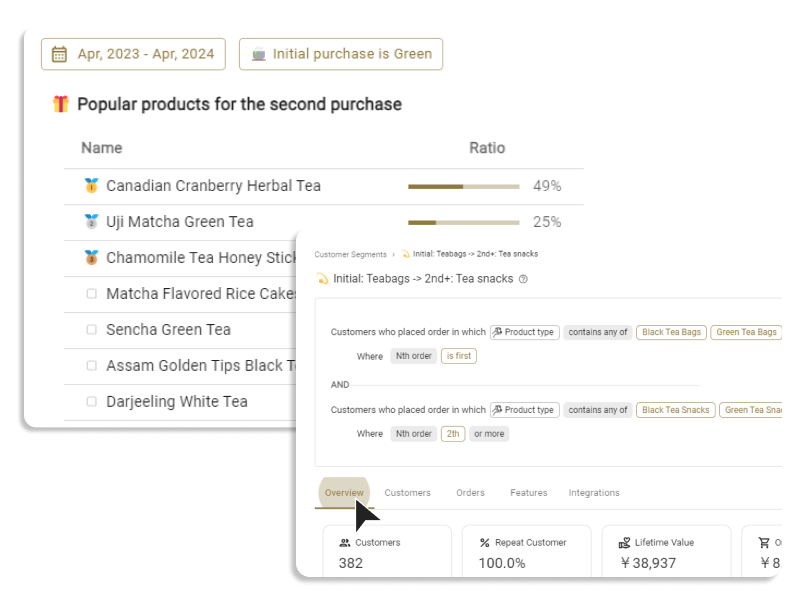

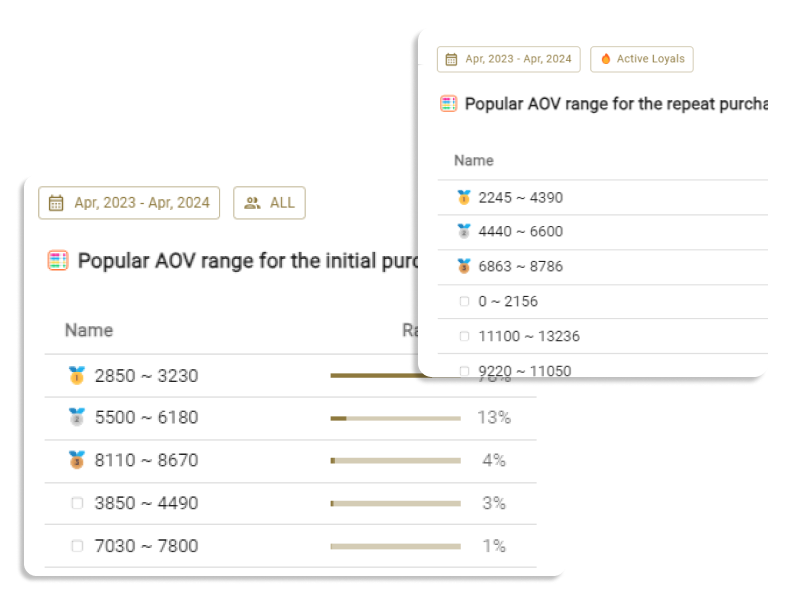

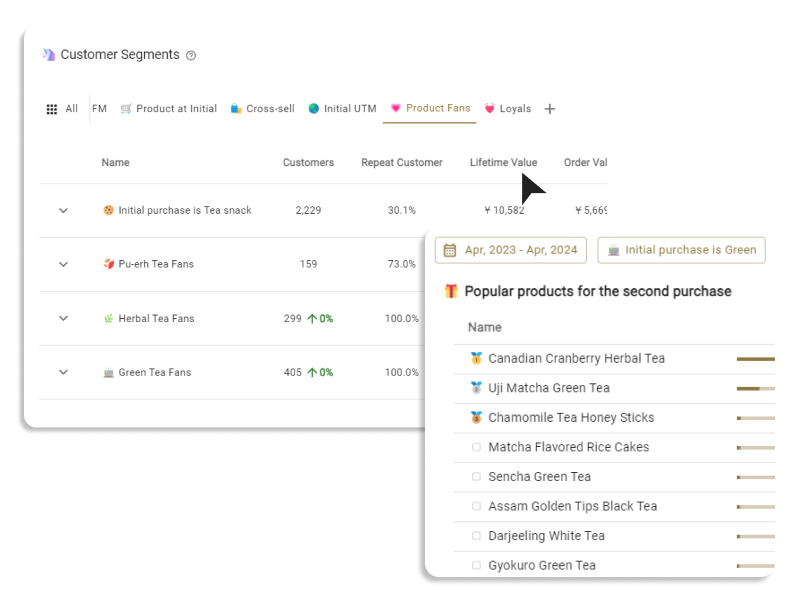

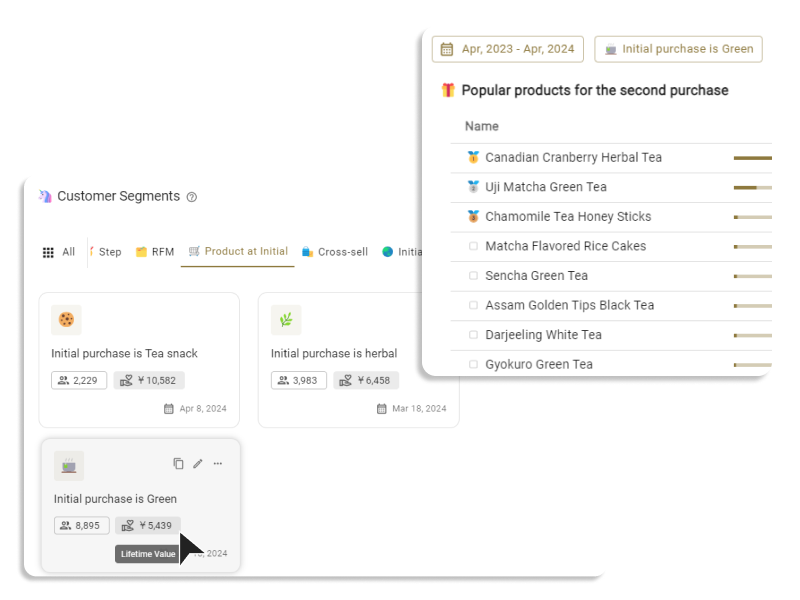

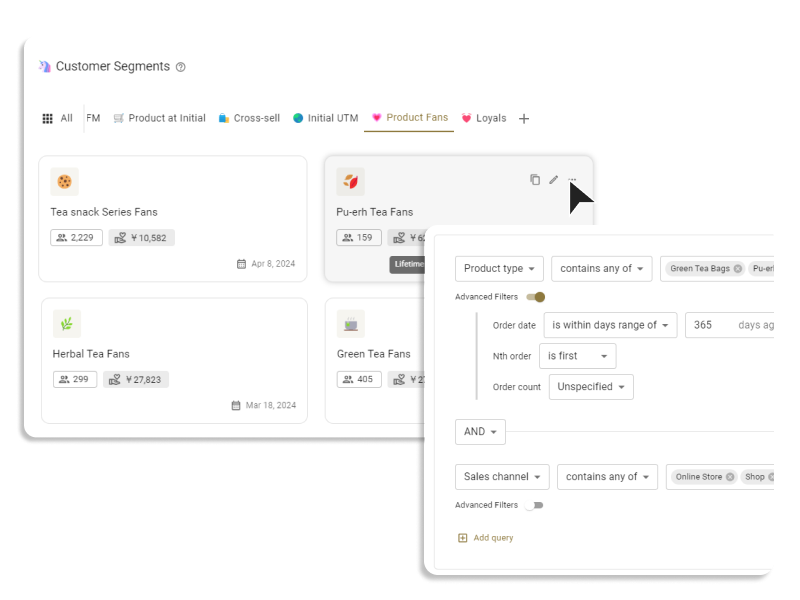

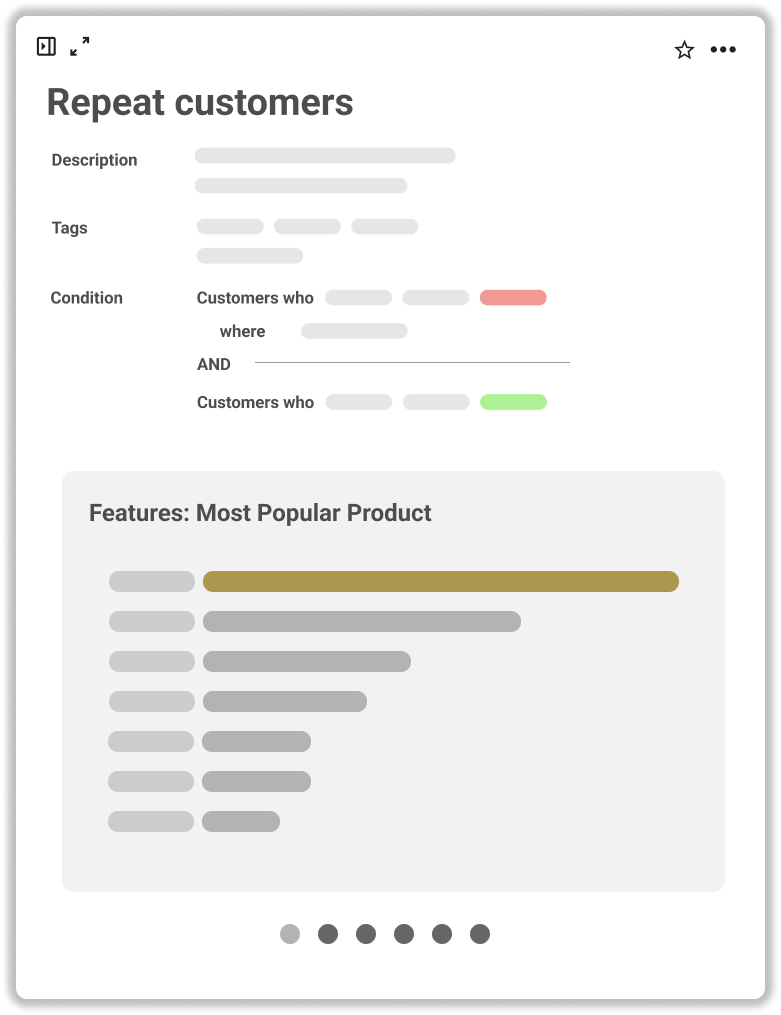

Even within the same store, CLV differs depending on needs and purchase intentions. For instance, in an eCommerce store for baby and kids' products, customers who mainly buy toys will differ in average order amount and purchase frequency from those who primarily buy consumables like diapers. While toys might be purchased continuously until the child reaches a certain age, the lifespan of customers buying diapers might last only a few months to a few years at most. In this case, marketing measures to improve CLV for customers buying toys and those buying diapers should naturally be treated separately.

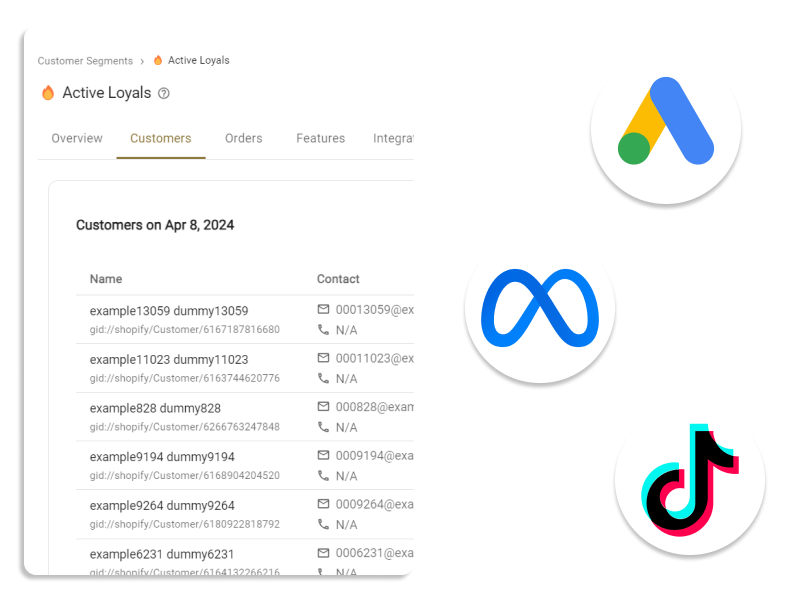

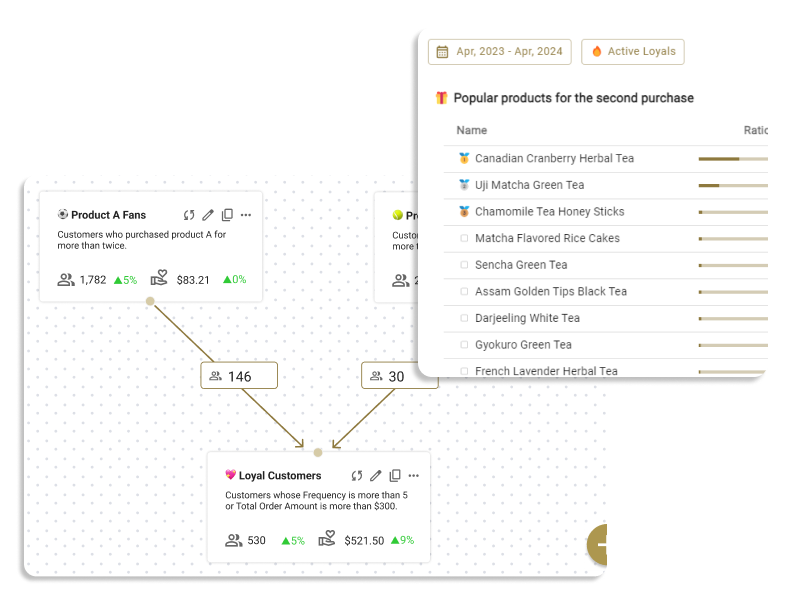

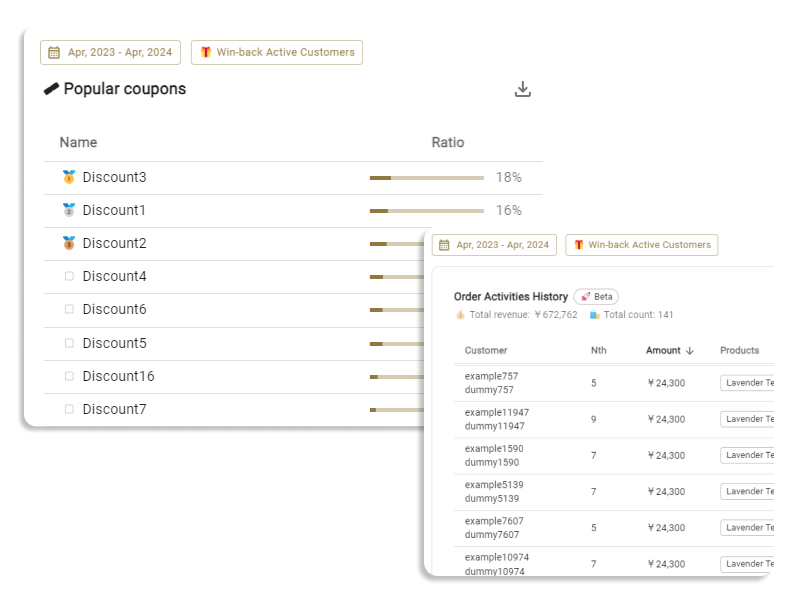

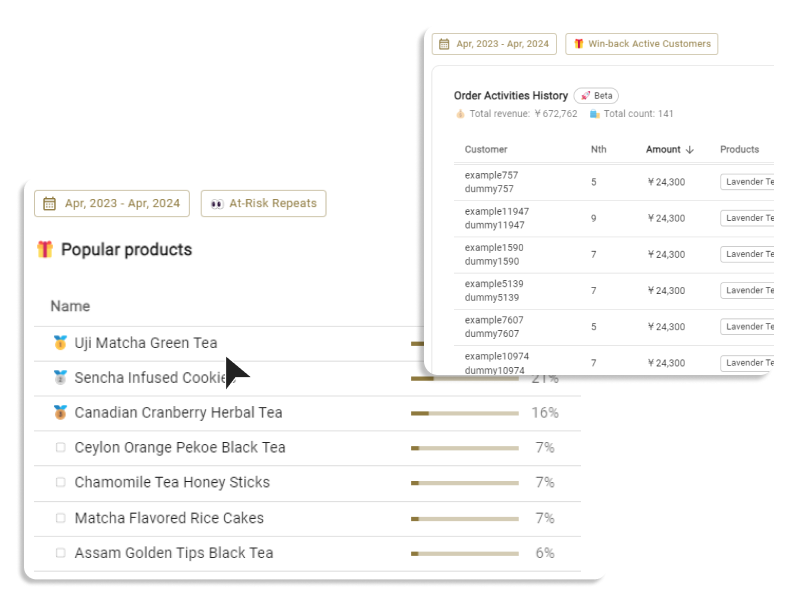

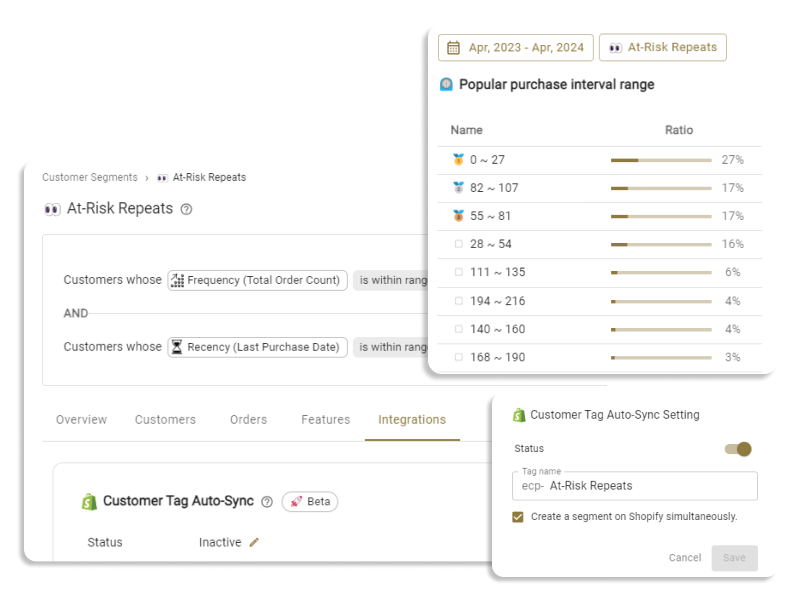

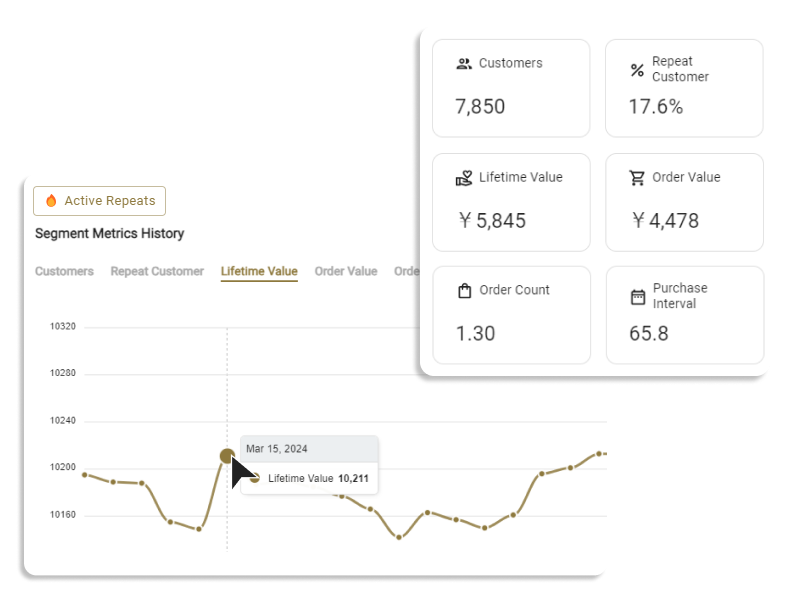

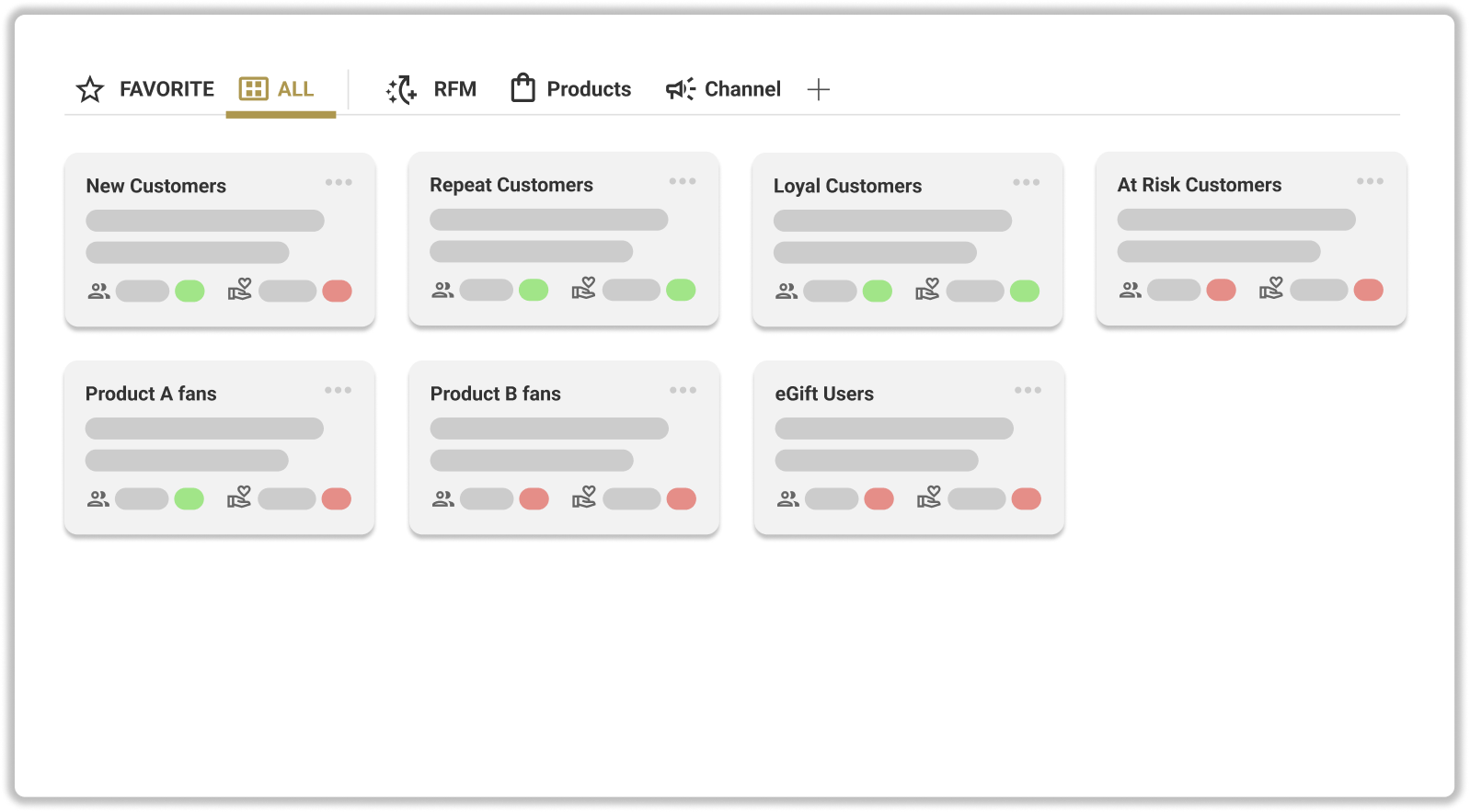

Thus, for Merchants that cater to customers with varied needs and purposes or that carry a wide product lineup, while the overall CLV can be a useful KPI, it often doesn't lead to specific actions for marketing professionals. Marketers need to create appropriate customer segments and manage and strategize for CLV on a segment-by-segment basis.

Our company offers the customer segmentation tool "ECPower" for eCommerce marketers. If you resonate with the idea of improving CLV on a segment-by-segment basis, please check our product site.

Conclusion

In this article, we have discussed practical CLV calculation methods for eCommerce stores and representative methods to enhance CLV. For eCommerce marketing professionals, it is essential to manage CLV by segment. It is crucial to understand and implement strategies based on CLV. We hope you find this article helpful and can apply its insights to your work.